how to calculate sales tax in oklahoma

Alone that would be the 14th-lowest rate in the country. Average Local State Sales Tax.

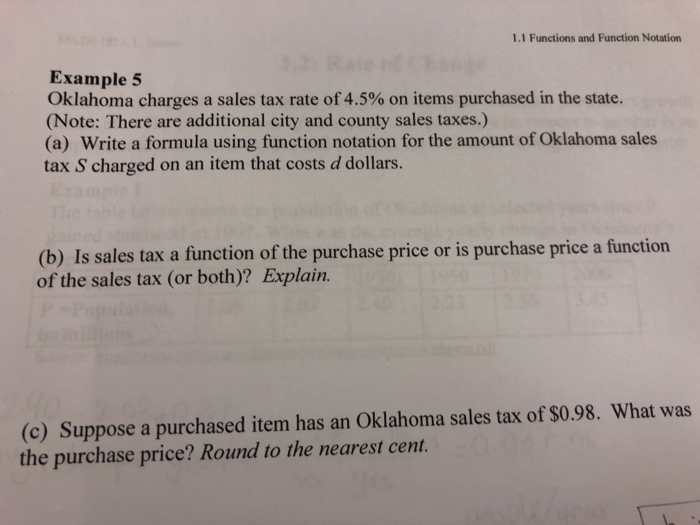

Solved 1 1 Functions And Function Notation Example Oklahoma Chegg Com

Oklahoma all you need is the simple calculator given above.

. The state sales tax rate in Oklahoma is 450. The average cumulative sales tax rate in Oklahoma City Oklahoma is 875 with a range that spans from 85 to 95. Sales Tax Table For Oklahoma.

Oklahoma Income Tax Calculator 2021. Oklahoma also has a vehicle excise tax as follows. In Oklahoma this will always be 325.

Maximum Possible Sales Tax. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Item or service cost x sales tax in decimal form total.

Maximum Local Sales Tax. Multiply the vehicle price before trade-in or incentives by the sales. This includes the rates on the state county city and special levels.

325 percent of the purchase price. You are able to use our Oklahoma State Tax Calculator to calculate your total tax costs in the tax year 202223. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Your average tax rate is 1198 and your. Oklahoma State Sales Tax. States have the right to impose their own taxes on residents and non.

The equation looks like this. The minimum is 725. All numbers are rounded in.

Enter the Amount you want to enquire about. The calculator will show you the total sales tax amount as well as the. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115.

The base state sales tax rate in Oklahoma is 45. If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520. The Oklahoma state sales tax rate is 45.

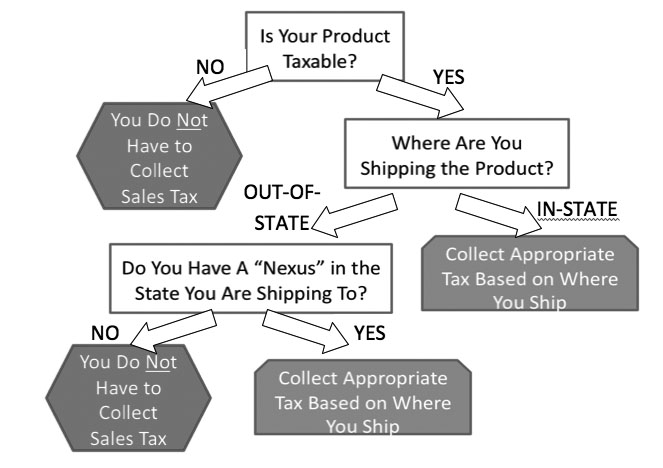

Multiply the vehicle price after trade-ins and. If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship. This includes the rates on the state county city and special.

In Oklahoma this will always be 325. Income tax 05 - 5. Sales Tax Handbook 2022 Oklahoma Sales Tax Table A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an.

Multiply the cost of an item or service by the sales tax in order to find out the total cost. The average cumulative sales tax rate in Tulsa Oklahoma is 871 with a range that spans from 852 to 98. Depending on local municipalities the total tax rate can be as high as 115.

The Oklahoma OK state sales tax rate is currently 45. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. To know what the current sales tax rate applies in your state ie.

Oklahoma Sales Tax. This includes the rates on the state county city and. You can use our Oklahoma Sales Tax Calculator to look up sales tax rates in Oklahoma by address zip code.

Our calculator has recently been updated to include both the latest Federal. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Other local-level tax rates in the state of Oklahoma.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. However in addition to that rate Oklahoma has. The average cumulative sales tax rate in Oklahoma County Oklahoma is 879 with a range that spans from 85 to 10.

Multiply the vehicle price by the sales. 20 on the first 1500 plus 325 percent on the remainder. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 771 in Oklahoma.

When Will Your City Feel The Fiscal Impact Of Covid 19

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Taxes In The United States Wikipedia

4 Ways To Calculate Sales Tax Wikihow

Keeping Perspective Oklahoma Policy Institute

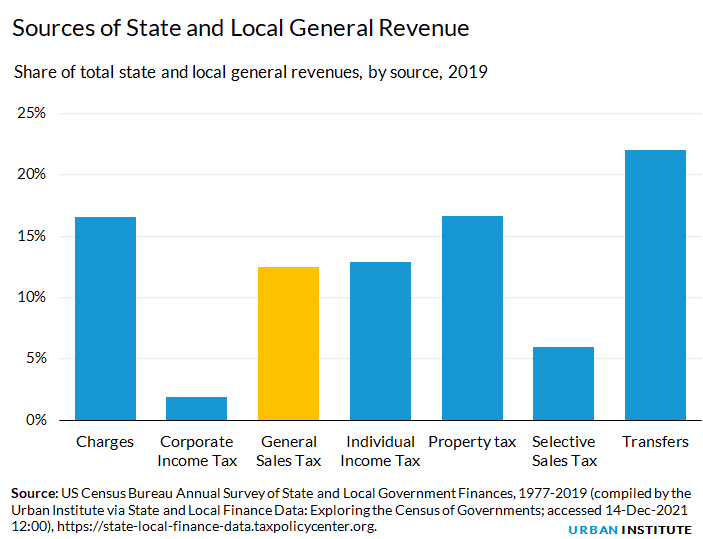

General Sales Taxes And Gross Receipts Taxes Urban Institute

Oklahoma Sales Tax Calculator Reverse Sales Dremployee

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Saas Sales Tax For The Us A Complete Breakdown

Oklahoma Voters In Texas County To Determine Sales Tax To Benefit Memorial Hospital Kvii

Online Sales Tax In 2022 For Ecommerce Businesses By State

Oklahoma Sales Tax Calculator And Local Rates 2021 Wise

Sales Tax Finds Use On Road How Surrounding States Fund Highway Upkeep

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

E Commerce And Sales Taxes What You Collect Depends On Where You Ship Oklahoma State University

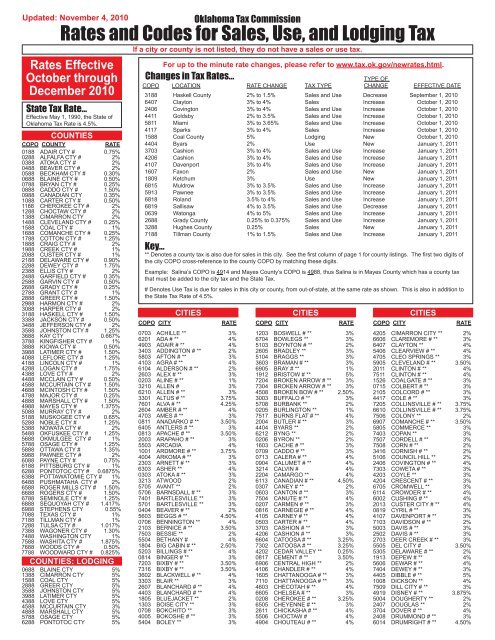

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Etsy Marketplace Collects Sales Tax For You Accounting For Jewelers

How Oklahoma Sales Tax Calculator Works Step By Step Guide 360 Taxes